Lottery Licensing Policy Manual

Download a PDF version of this document

Introduction

This Lottery Licensing Policy Manual (LLPM) contains the policies and procedures that municipal and provincial officials must follow to issue and administer charitable gaming licences in Ontario.

These policies reflect the mandate of the AGCO to regulate charitable lotteries to ensure they are conducted with honesty and integrity, and in the public interest.

For the purposes of this manual, “lottery” means a gaming event or scheme that is conducted by a charitable or religious organization or a non-profit group with charitable objects and purposes. The policies apply to raffles, break open ticket sales, charity bingo and one-time special occasion gaming events and bazaars run by these organizations.

PURPOSE OF THE LLPM

The LLPM has been designed to ensure lottery licences are issued and administered on a consistent basis throughout the province.

The AGCO also uses the LLPM to communicate changes in the Registrar’s policies and in the regulatory structures for lottery licensing.

HOW TO USE THE LLPM

Printed versions of the LLPM should not be considered up to date. Before making any decisions regarding a lottery application or licence, users of this manual should refer to the AGCO website for any amendments to the legislation and any new terms and conditions and information bulletins as well as any recent revisions of the LLPM.

A glossary of lottery licensing terms is provided at the end of this manual.

Municipal and AGCO lottery licensing staff

Lottery licensing staff should read and become familiar with the full manual as well as the various terms and conditions and guidelines, which are all provided on the Charitable Gaming: Municipalities portal on the AGCO web site.

Licensees and applicants

Licensees and applicants are advised to read the first three chapters of the LLPM as well as the chapter related to the lottery type they intend to conduct. They should also read the Lottery Licence Terms and Conditions, the terms and conditions for their lottery type and any additional documents that may relate to their lottery type. Get the most recent versions of all these documents from the Charitable Gaming: Charitable and Religious Organizations portal on the AGCO web site.

Note to lottery licence applicants

Raising funds through gaming contains a certain element of risk on the part of the charitable organization– lotteries should be viewed as a supplement or alternative to the organization’s other fundraising ventures: Lottery proceeds may not be the main source of fundraising for a charitable organization.

Chapter 1: Regulatory Framework

1.1.0. Introduction

The lottery licensing policies in this manual were developed by the Registrar, based on authority and direction flowing from:

- the Criminal Code (Canada);

- Order-in-Council 208/2024 (as amended); and

- the Gaming Control Act, 1992 and its Regulations.

Each type of licensed lottery is governed by a specific set of rules known as “terms and conditions.”

1.1.1. BACKGROUND

In Canada, all authority to license gaming activity flows from provisions in the Criminal Code (Canada), which makes it possible for eligible charitable and religious organizations to conduct and manage lottery schemes under a licence issued by the appropriate provincial authority.

Based on the authority conferred by the Criminal Code, the Government of Ontario has passed an Order- in-Council 208/2024, delegating its authority to license charitable gaming events to:

- the Registrar, and

- municipal councils.

The Registrar has the authority to license all types of approved lottery events. Municipal councils may license certain types of approved lottery events.

1.1.2. THE CONTEXT OF GAMING IN ONTARIO

The responsibility for gaming in Ontario has been divided into three main areas: regulation, licensing of charitable gaming, and conduct and management.

(A) Regulation

The Alcohol and Gaming Commission of Ontario (AGCO) is responsible for regulating:

- commercial gaming (including casinos and internet gaming);

- charity casinos;

- slot machine facilities at racetracks; and

- charitable gaming.

(B) Licensing of charitable gaming

The Registrar as well as municipal councils may issue charitable gaming licences, as outlined in this manual.

(C) Conduct and management

The Ontario Lottery Gaming Corporation (OLG) is responsible for the conduct and management of:

- commercial casinos;

- internet gaming;

- charity casinos;

- electronic bingo centres; and

- slot machines at racetracks.

Where a charitable or religious organization is licensed, it too may conduct and manage a lottery scheme.

1.2.1. The Regulatory Framework

The current regulatory framework is based on six key elements :

- the Criminal Code (Canada)

- the Gaming Control Act, 1992 and its Regulations

- the Order-in-Council 208/2024

- the terms and conditions

- Standards and Directives issued by the Registrar

- the Lottery Licensing Policy Manual, together with all updates and information bulletins .

1.2.1 (A) The Criminal Code (Canada)

Eligible charitable and religious organizations may conduct and manage lottery schemes under a licence issued by the appropriate provincial authority under an exception to the Criminal Code (Canada) general prohibition on gambling.

In this manual the term “charitable” includes both “charitable and religious” organizations as referred to in the Criminal Code (Canada).

1.2.1 (B) The Gaming Control Act, 1992

The Gaming Control Act, 1992 regulates the commercial sector of the charitable gaming industry. Among other things, the Act details:

- the requirement to register individuals, corporations, organizations, associations and partnerships that supply gaming services or goods to licensed charitable organizations

- the registration process

- the types of goods and services that may be provided

- the manner in which goods and services may be provided

- reporting responsibilities

- the Registrar’s authority to establish standards and requirements for the conduct, management and operation of gaming sites or lottery schemes under the Act; and

- the registration appeal process.

The Lieutenant Governor in Council may make Regulations prescribing anything required under the Act. For example, the Regulations currently in force establish such things as exemption from registration, classes of registrants and terms of registration.

1.2.1 (C) Order-in-Council 208/2024

The Order-in-Council :

- defines the roles and responsibilities of municipal councils and the Registrar; and

- outlines the authority of the Registrar and municipalities to license and regulate certain lottery events.

It also provides broad policies for the administration of lottery events and general terms and conditions for the conduct of lotteries.

The Order-in-Council does the following:

- stipulates that proceeds from licensed lottery schemes must be used only for a charitable or religious object providing a direct benefit to the residents of Ontario

- outlines certain standard licence requirements

- gives the Registrar authority to attach terms and conditions to any licence

- gives a municipal council authority to attach terms and conditions to any licence it issues, provided these do not conflict with those of the Registrar

- gives the Registrar authority to consent to a licensee conducting and managing a lottery scheme in one or more provinces in addition to Ontario

- gives the Registrar and municipal councils authority to refuse, suspend or cancel a licence, under specified circumstances.

1.2.1 (D) Terms and conditions

The Registrar issues a specific set of rules, known as the terms and conditions, to regulate each type of licensed lottery event. The terms and conditions provide detailed instructions for the conduct and management of licensed lottery events. For example, the terms and conditions govern:

- the role of the licensee

- the types and amounts of prizes to be awarded

- rules of play

- licence fees

- banking guidelines

- reporting requirements.

The Registrar may impose additional terms and conditions on any lottery licence, as necessary. A municipal council may impose additional terms and conditions on any lottery licence it issues, provided they do not conflict with those of the Registrar. Licensees must observe all the terms and conditions of their lottery licence.

1.2.1 (E) Standards and Directives issued by the Registrar

The Registrar may issue Standards and Directives that must be followed by licensees and registrants.

1.2.1 (F) Lottery Licensing Policy Manual (LLPM)

This Lottery Licensing Policy Manual (LLPM) contains the policies and some of the procedures licensing officers must use when issuing and administering lottery licences. The policies are derived from the legislation and regulations to address specific aspects of lottery licensing to ensure consistency throughout the province. The manual is updated to contain any policy matters addressed in relevant Information Bulletins, Standards and Directives.

The AGCO also uses the LLPM to communicate changes in the Registrar’s policies and in the regulatory structures for lottery licensing.

1.3.1. The Roles Of The Registrar

The AGCO was established under the Alcohol, Cannabis and Gaming Regulation and Public Protection Act, 1996 . Order-in-Council 208/2024 gives the Registrar authority to administer the lottery licensing provisions of the Criminal Code (Canada) for the Province of Ontario.

The Registrar’s areas of authority include such things as issuing registrations under the Gaming Control Act, 1992 ; the issuance, suspension and cancellation of gaming licences; conducting inspections; setting standards; requiring reporting for licensees; and setting fees and terms and conditions on licences.

1.4.1. The Roles of Municipalities

1.4.1 (A) Issuing lottery licences

Municipal councils have the authority to issue licences for most lottery events conducted in their communities, including:

- bingo events with prize boards of up to $5,500

- non-electronic raffles with prizes of up to $50,000

- break open ticket events that are not conducted in conjunction with another licensed gaming event, and where the tickets are sold within the municipality

- bazaar gaming events

- media bingo.

1.4.1 (B) Municipal administrative responsibilities

As long as it does not contravene criteria established by the Registrar, a municipal council may develop additional criteria, through bylaws and policies, for making licensing decisions and administering lottery licensing in their municipality.

Municipalities must also:

- report any information required by the Registrar

- enforce licensing policies

- ensure that licensees comply with the terms and conditions of their licences

- investigate any breaches of the terms and conditions.

A municipal council may refuse, suspend or cancel licences, in accordance with the Order-in-Council and the Registrar’s policies. The AGCO is available to assist the municipality in any compliance and investigation matters.

Municipalities that issue licences also must ensure that applicants are eligible for lottery licences (see Chapter 2); be fair and equitable when issuing licences; and remain satisfied that licensees continue to meet the requirements of the Criminal Code (Canada), the Order-in-Council and the terms and conditions of their licences.

1.5.1. Refusing, Cancelling Or Suspending A Licence

The Registrar or municipality may suspend or cancel lottery licences where:

- there has been a breach of any term, condition, Directive or Standard

- there are reasonable grounds to believe that the applicant or licensee will not conduct and manage the lottery scheme in accordance with law or with honesty and integrity

- in its opinion it is in the public interest to do so

- an applicant or licensee fails to submit financial reports or other information in accordance with the Registrar’s requirements.

The Registrar also has the power to refuse to issue a licence for the grounds set out in section 5 of the Order-in-Council or to suspend or cancel a licence issued by a municipal council.

If an organization continues to conduct lottery events after its licence has been suspended or cancelled, the lottery events will be illegal pursuant to the Criminal Code (Canada).

See Order-in-Council 208/2024 , as well as 3.4.1, “Suspending or cancelling lottery licences,” and 5.11.1, “Requests to cancel raffle licences.”

1.6.1. Enforcement and Compliance

Each municipality has the responsibility to investigate any contraventions of the terms and conditions of a licence it issues. A municipality may request the assistance of the local police force or the AGCO.

Municipalities have the authority to:

- investigate suspected contraventions of the terms and conditions of the licensed lottery scheme

- investigate suspected financial and management improprieties of licensed organizations and persons

- conduct audits of licensed organizations.

In addition to the above, the Registrar has the authority to:

- conduct investigations under the Gaming Control Act, 1992

- assist municipalities/local enforcement agencies in any investigation or audit of a licence.

1.7.1. Guiding Principles

In order to ensure that lottery licensing is administered fairly and consistently, lottery licensing decisions must be guided by the following fundamental principles:

- Consider the needs of the community as a whole. All eligible organizations must have fair access to gaming opportunities.

- Consider both the viability of a proposed lottery scheme and the applicant’s ability to execute the scheme.

- Lottery proceeds must only be used for the direct delivery of eligible charitable programs and services, as stated on the licence application and approved by the licensing authority.

Chapter 2: Eligibility And Use of Proceeds

2.1.0. Introduction

This chapter outlines the policies and procedures a licensing official must follow to determine:

- whether an organization is eligible to receive a lottery licence

- whether an organization’s proposed use of lottery proceeds is eligible.

To be eligible to receive a lottery licence, an organization must first have charitable objects and purposes that fall within one of the four classifications of charitability:

- the relief of poverty

- the advancement of education

- the advancement of religion

- other charitable purposes beneficial to the community, not falling under (a), (b) or (c).

Determining an organization’s eligibility for lottery licensing is a complex process. The guidelines set out in this chapter cannot be considered independently of each other; a licensing official must consider all circumstances to determine which of the organization’s objects or purposes and activities fall within one of the four charitable classifications. It is not sufficient to look at an organization’s purposes to decide whether it qualifies as charitable: it is also necessary to look at the organization’s activities.

A licensing official may reference decisions made by the courts, the Canada Revenue Agency and Office of the Ontario Public Guardian and Trustee as a guide to eligibility decisions. However, registration under the federal Income Tax Act as a charitable organization does not confer automatic lottery licensing privileges. Similarly, approval of letters patent of incorporation by the Office of the Ontario Public Guardian and Trustee does not confer automatic lottery licensing privileges. Licensing officials must make eligibility decisions on a case-by-case basis, by considering the specific circumstances of each organization.

Licensing officials must determine the eligible uses of lottery proceeds for each organization by examining the charitable classification of the organization’s objects or purposes and activities. For example, an organization that has not demonstrated that it has an object that falls within the “relief of poverty” classification cannot use lottery proceeds to operate a food bank.

Some organizations have objects or purposes and activities that fall within more than one of the four charitable classifications. In this case, eligible uses of lottery proceeds may also fall within more than one of the four classifications.

This chapter is provided as guidance. It is not intended to provide definitive statements with regard to any organization that may apply for a lottery licence. It provides details regarding:

- the process that must be followed

- guidelines for making eligibility decisions

- some examples of organizations and uses of proceeds that may be eligible.

The examples are not exhaustive. They are provided to describe the principles a licensing official must use to determine the eligibility of an organization’s objects or purposes and activities.

Organizations must be continuously reviewed and reassessed to ensure continued eligibility. The examples used in this chapter reflect the current interpretation of what is eligible. It is the duty of licensing authorities to remain current.

2.1.1. What Is Charitable?

To be eligible for a lottery licence, an applicant must qualify either as an eligible charitable organization or as a non-profit organization with charitable objects or purposes.

There is no general statutory definition of “charity” and “charitable.” Although there are many worthwhile activities and causes, not all are considered charitable. An essential and common element in the determination of what is charitable is the provision of “public benefit.” What is considered to benefit the public does not remain constant. It changes with the changing values and needs of society and reflects the social conditions of the time.

In order to determine which organizations are eligible for lottery licences, the Alcohol and Gaming Commission of Ontario (AGCO) uses the four charitable classifications described in the next sections. In order to qualify for a lottery licence, an organization must demonstrate that it exists to provide services in one of the four charitable classifications. In addition, an eligible organization must also meet all of the following criteria:

- It provides a charitable benefit to residents of Ontario.

- It benefits the public at large, not a private group.

- An organization that is established solely for the benefit of its members is not an eligible organization. It does not have a public benefit.

- It does not restrict access to its benefits.

- Organizations may direct their charitable works towards specific segments of the community or individuals with a common need, provided that more than a few individuals benefit, and the charitable benefit is accessible to the public at large.

- An organization that otherwise restricts access is not an eligible organization. Organizations that exist to provide service to individuals with a common need may provide services on an individual basis.

- Its income is not paid to or used for the personal benefit of its members, its members’ relatives or anyone who is not at arm’s length from the organization.

- An organization that transfers income or assets to its members for their personal benefit is not an eligible organization.

- Projects with a charitable object or purpose are one of its main aims and normal activities.

- An organization that does not have a mandate to provide charitable works and does not provide charitable works on a regular basis is not an eligible organization.

An organization may have objects or purposes that focus its activities towards a specific segment of the community, for example, Indigenous persons, senior citizens or people with physical or developmental disabilities. Such organizations may be eligible if their objects or purposes and activities fall within one of the four charitable classifications. A licensing official must assess the activities of the organization in order to determine whether the organization is eligible and, if so, within which of the four charitable classifications it falls:

- the relief of poverty

- the advancement of education

- the advancement of religion

- other charitable purposes beneficial to the community, not falling under (a), (b) or (c).

2.1.2. Overview: The Four Charitable Classifications

(A) The relief of poverty

The “relief of poverty” classification includes organizations that assist the economically disadvantaged by directly providing goods, social services, programs or facilities. The financial and other assistance provided is intended to alleviate the effects of living in poverty.

Poverty must be considered in relation to current economic and social conditions. The provision of goods or services to relieve poverty is intended to ensure that individuals have a basic standard of living. Individuals do not have to be destitute in order to qualify for this assistance.

Food banks, soup kitchens and organizations that provide clothing, furniture and appliances are examples of these types of organizations.

See also “2.7.1. Policies: The relief of poverty”.

(B) The advancement of education

The courts have defined the “advancement of education” as:

- significant training or instruction

- the development of mental faculties

- the improvement of a branch of human knowledge, which results in a public benefit.

Simply providing information does not meet this definition: significant training or instruction must also be offered.

To meet this definition, the instruction must be available to a wide section of the public and must not be restricted by any means. It is not necessary for an organization to provide instruction or training in a formal classroom setting, but its activities must improve human knowledge and provide a public benefit through instruction.

Teaching institutions and schools are examples of organizations that may fall within this charitable classification.

See also “2.7.2. Policies: The advancement of education”.

(C) The advancement of religion

The “advancement of religion” refers to:

- the promotion of a religious group’s spiritual teachings

- the maintenance of the doctrines and spiritual observances upon which those teachings are based.

To be eligible as a charitable organization in this classification, a group’s spiritual beliefs or faith must include an element of worship of a personal God, gods or deities. Fostering a belief in proper morals or ethics alone is not enough to qualify a group as an eligible organization in this classification.

The group’s activities must also include an element of public instruction and the promotion of spiritual teachings. Its activities must serve religious purposes for the public good. The group’s beliefs and practices cannot include anything the courts consider subversive, immoral or illegal.

Places of worship, such as churches, mosques, temples and religious congregations, are examples of these types of organizations.

See also “2.7.3. Policies: The advancement of religion”.

(D) Other charitable purposes beneficial to the community

This is the broadest classification and the most difficult to consider. An organization with a charitable purpose that does not fall under one of the first three classifications may be eligible in this classification. The organization’s activities must provide a public, not private, benefit.

The phrase “other charitable purposes beneficial to the community” has been interpreted to include activities that benefit the whole community, without discrimination, so that the purposes have a truly public character. This may include:

- the promotion of arts and cultural activities

- cultural, ethnic, native, historic or heritage pursuits

- the improvement of the quality of health through medical research

- treatment programs and preventative programs

- youth sporting activities

- community projects undertaken by service organizations.

See also “2.7.4. Policies: Other charitable purposes beneficial to the community”.

2.2.0. Overview: Eligible Organizations

In general, eligible organizations fall into one of two categories.

- Charitable organizations: the organization’s objects or purposes are all charitable.

- Non-profit organizations with charitable objects: the organization has a mixture of charitable and non-charitable purposes.

2.2.1. POLICIES: CHARITABLE ORGANIZATIONS

In order to be considered a charitable organization for the purposes of lottery licensing, an organization must have objects or purposes and activities that are exclusively and wholly charitable. A charitable organization cannot have a mixture of charitable and non-charitable purposes or activities.

Charitable organizations have a number of characteristics:

- They are non-profit organizations. Charitable organizations do not make a profit nor do they distribute profits to their members.

- Charitable organizations provide benefits to the public or a specified segment of the public.

- Charitable organizations are restricted to carrying out activities that advance their objects, which must be exclusively charitable. Their business activities are restricted and the public benefit they provide must be of a nature recognized by the courts as charitable.

The Office of the Public Guardian and Trustee has supervisory responsibility for charitable organizations and their use of charitable funds. Charitable organizations must comply with the reporting requirements of the Charities Accounting Act and the ownership restrictions set out in the Charitable Gifts Act.

Charitable organizations may register with the Canada Revenue Agency. However, registration as a charitable organization for the purposes of the Income Tax Act does not automatically qualify an organization for lottery licensing.

2.2.2. POLICIES: NON-PROFIT WITH CHARITABLE OBJECTS

Organizations that have a mixture of charitable and non-charitable objects or purposes may be considered to be “non-profit with charitable objects.” A non-profit organization with charitable objects is eligible to receive lottery licences if its charitable mandate falls within one of the four charitable classifications and it meets all the other relevant criteria.

Non-profit organizations have a number of characteristics in common with charitable organizations. However, non-profit organizations do not have the same level of restriction placed on their business activities and the public benefit that they provide.

If an organization’s application does not include documentation proving its status as a charitable organization, it should be considered against the eligibility criteria to determine whether it is a non-profit organization with charitable objects.

2.2.3. POLICIES: SUB-GROUPS OF ELIGIBLE ORGANIZATIONS

If a licensing official receives an application from an organization that appears to be a sub-group, “partner” or auxiliary of another eligible organization, the official must ask the following questions in order to determine the status of the two organizations:

- Are the organizations separate legal entities? For example, if the parent organization dissolves, will the sub-group still exist?

- Do the organizations have different Boards of Directors?

- Do the organizations have independent budgets, banking procedures and funding?

- Do the organizations have differing mandates or purposes?

- Does one of the organizations have overall control, or influence, on the decisions of the other organization?

If the comparison shows that the two organizations exist for the same purposes, the parent group may be licensed if it is an eligible organization. The sub-group, “partner” or auxiliary may only be licensed where the parent group chooses not to conduct lottery events and permits the sub-group, “partner” or auxiliary group to hold lottery licences on its behalf.

2.2.4. POLICIES: ORGANIZATIONS THAT AMALGAMATE

2.2.4 (A) Amalgamation: Two or more eligible organizations

If two or more eligible organizations amalgamate, the resulting entity must be treated as one organization for lottery licensing purposes. For example, if two community service organizations that each have a break open ticket licence amalgamate, the new organization may have only one licence. When two or more eligible organizations amalgamate, licensing officials must complete a full eligibility review.

Eligible organizations that amalgamate must disburse the funds in their designated lottery trust accounts for the purposes approved by the licence. The funds may be disbursed after amalgamation. If the funds are not disbursed before amalgamation, the licensing authority must approve the disbursement of funds.

2.2.4 (B) Amalgamation: An eligible organization and an ineligible organization

When an eligible organization amalgamates with an ineligible organization, the new organization may or may not be eligible for lottery licensing. Licensing officials must complete a full eligibility review before issuing any new lottery licences.

An eligible organization that amalgamates with an ineligible organization must disburse the funds in its designated lottery trust account before amalgamation, for the purposes approved on the licence. The licensee must notify the licensing authority of the disbursement.

Prior to the disbursement of funds the lottery licensing authority must approve any request to hold lottery proceeds in a designated lottery trust account past the date of amalgamation and must also give prior approval of any final disbursement that occurs after amalgamation.

2.3.0. Overview: Ineligible Organizations

An organization is ineligible for a lottery licence if:

- it is established as a profit-making entity;

- it does not have a charitable object or purpose;

- it promotes private benefits to a restricted class of members;

- it is established solely for the purpose of adult recreation;

- it is established for the purpose of tourism or other activities that are purely economic in nature; or

- it is a sub-group, “partner” or auxiliary of an eligible organization that is already licensed.

2.3.1. POLICIES: INELIGIBLE ORGANIZATIONS

Organizations ineligible for lottery licensing include:

- professional associations, unions and employee groups, except those set up to carry out charitable activities;

- elected representative groups, including municipal, regional, provincial and federal governments;

- government agencies or bodies;

- political lobby groups and those attempting to persuade the public to adopt a particular view on a political issue;

- advocacy, self-help and other groups solely dedicated to the political, personal and financial advancement of their members;

- However, if direct services that fall into one of the four charitable classifications are provided, advocacy or case management intended to represent individuals and secure appropriate charitable services for those individuals may be considered an eligible charitable purpose.

- political parties;

- adult hobby groups;

- for-profit, members-only or private sports clubs and for-profit adult sports teams and leagues;

- those promoting a political doctrine;

- those attempting to bring about or oppose changes in the law or government policy;

- municipal councils, municipal corporations and their administrative departments; and

- organizations established solely for the purpose of fundraising.

The above list is not intended to be exhaustive. Every organization must be reviewed, based on the documents provided, since all organizations are unique.

2.3.2.POLICIES: GOVERNMENTS

Governments are political bodies established for administrative purposes. Their primary mandate is to govern, which is not a charitable object. Services provided by governments may provide a public benefit and, if provided by a charitable organization, may be considered a charitable activity. However, a government is not a charitable organization and is not eligible for lottery licensing.

When reviewing organizations that are associated with governments, licensing officials must determine the extent to which the organization is:

- separate legally, administratively and financially from the government; and

- controlled by the government.

For example, conservation authorities established under the Conservation Authorities Act are not separate legally, administratively and financially from the government. Therefore, typically these types of organizations are not eligible for lottery licensing.

2.3.2 (A) Municipalities

A licensing authority must never issue a lottery licence to a municipality or one of its administrative departments. Municipalities derive their powers from the Municipal Act or, in some cases, a constituting act. As entities established primarily for local administration, they are not given the power to carry out charitable objects or to conduct lottery schemes. Therefore, municipalities and their operating committees or agencies do not meet the definition of a charitable organization and do not qualify for licensing under Section 207(1)(b) of the Criminal Code.

When reviewing organizations associated with a municipality, a licensing official must determine the extent to which the organization is controlled by the municipality and whether the organization is separate legally, administratively and financially from the municipality.

2.3.2 (B) Public libraries

Public libraries constituted under the Public Libraries Act are not separate financially and administratively from the municipality. Therefore, boards of public libraries established under the Public Libraries Act are not eligible for lottery licences.

2.3.2 (C) Other agencies funded by government

Many agencies operate under legislation and receive government funding. To determine the eligibility of these organizations, a licensing official must review the legislation that sets out the organization’s mandate and its relationship to government. Whether the organization is separate legally, administratively and financially from government and the degree of control exercised by government over the organization will determine whether the organization is eligible for lottery licensing.

2.4.0. Overview: Eligible Use Of Proceeds

Once a licensing official has decided an applicant is eligible to receive a lottery licence, the licensing official must examine the intended use of lottery proceeds listed on the licence application.

In order to determine the eligibility of the proposed use of proceeds, a licensing official must review the organization’s programs and services.

As outlined in Section 2.1.0, an eligible organization’s charitable objects and purposes must fall within one of four classifications. The eligible uses of proceeds will vary by classification and by eligible organization. As such when determining what is considered an eligible use of proceeds for an eligible organization, the following factors must be taken into consideration:

- under which of the four classifications the objects and purposes of the organization fall;

- the mandate of the organization;

- the type of organization; and

- the organization’s structure.

Eligible uses of proceeds must be:

- in themselves charitable and advance the charitable objects and purposes of the organization;

- used for the direct delivery of the charitable objects or purposes of the organization; and

- directed toward specific segments of the Ontario community or residents of Ontario with a common need.

A licensing official must determine the eligible uses of proceeds on a case-by-case basis. To determine which of the organization’s ongoing costs are eligible, the licensing official should review the proposed budget against the organization’s stated mandate. Only those costs that relate directly to the delivery of its eligible programs should be approved as eligible uses of lottery proceeds.

In addition to using lottery proceeds for the direct delivery of its eligible programs, an organization may also use lottery proceeds to pay some of the administrative expenses of those programs. To be considered an eligible use of lottery proceeds, these expenses must be essential for the direct delivery of the organization’s charitable objects. The licensing authority must give prior approval to requests to use lottery proceeds for administrative expenses on a case-by-case basis.

The licensing official may limit the use of proceeds to only those expenses that relate to the direct delivery of programs.

The licensing authority must monitor the use of lottery proceeds to ensure they are used as approved, for expenses related to the direct delivery of the eligible charitable services, for the benefit of Ontario residents.

2.4.0 (A) Uses in Ontario

All proceeds raised from lottery licences must be used for a charitable object or purpose that directly benefits the residents of Ontario. The funds do not necessarily have to be spent in Ontario, but an Ontario resident or community must benefit. This policy applies regardless of the beneficiary’s status as a citizen of Canada. For example, refugees living in Ontario may be beneficiaries of programs set up for the relief of poverty in Ontario. However, lottery proceeds cannot be used to bring non-residents to Ontario to then benefit from lottery proceeds. Also, proceeds must be used to generate a charitable, not an economic, benefit.

The following examples are eligible uses of lottery proceeds spent out-of-province to benefit a project or resident of Ontario:

- paying out-of-province medical expenses for an Ontario resident if the treatment is not available in the province, where the costs are not fully funded by the provincial government;

- buying medical equipment for an Ontario hospital from an out-of-province supplier; and

- paying the cost of an out-of-province educational opportunity for Ontario students enrolled in an accredited educational institution.

The following list provides some examples of projects that do not qualify:

- disaster relief provided to communities outside of Ontario;

- medical supplies for developing countries;

- foster child programs for children outside of Ontario;

- environmental projects outside of Ontario; and

- funding for foreign exchange students.

Although many of these activities are worthwhile projects, they provide a direct benefit to individuals outside Ontario. The Order-in-Council limits the allowable use of lottery proceeds to charitable activities that provide a direct benefit to the residents of Ontario.

2.4.1.POLICIES: ELIGIBLE USE OF PROCEEDS

2.4.1(a)(i) Donating to other eligible organizations

Eligible charitable organizations requesting approval to donate lottery proceeds to other eligible organizations must demonstrate that:

- their own charitable objects or purposes permit them to donate funds;

- the charitable organization has a proven track record of carrying out this activity;

- they have their own Board of Directors;

- they have budgets and banking procedures independent of the recipient organization;

- they are independent and have overall control over decision-making;

- the recipient organization in itself would be eligible for lottery licensing; and,

- the recipient organization will use the proceeds for an eligible use that is consistent with its charitable objects or purposes.

2.4.1 (a) (ii) Donating to other organizations

The same type of eligible charitable organization as described in Section 2.4.1(A)(i) may also in certain circumstances donate lottery proceeds towards goods or services for use by organizations that in themselves may not be considered charitable in nature, including those that are dependent upon municipal governments. In this instance it must be demonstrated that:

- the goods or services are not core goods or services historically provided by the recipient organization;

- there is no obligation for the recipient organization to provide the goods and services; and

- an agreement to protect the lottery proceeds is in place, prior to the transfer of funds.

An example of an eligible charitable organization donating lottery proceeds towards goods or services for use by another organization that in itself may not be considered charitable in nature:

A service club such as a Rotary Club raises funds for the inclusion of a public computer workstation for a public library established by a municipality. Raising funds for the inclusion of a computer may constitute a charitable use of funds by the club provided it can be shown that the proposed use is over and above the basic services that would normally be provided by the library.

An example of an ineligible use of proceeds:

A service club wishes to donate lottery proceeds to purchase jackets for a men’s baseball league.

2.4.1 (a) (iii) Donations for capital expenditures

In some cases, an eligible charitable organization that meets the criteria set out in 2.4.1(a)(i) may purchase or donate funds towards the purchase of a non-core item for another organization. The recipient organization must use the item for a purpose that provides a public, not a private benefit.

Prior to the purchase, the donating and recipient organizations must enter into a trust agreement outlining their respective responsibilities. The agreement must include the following information:

- who will hold title to the item;

- who maintains the item;

- the current value of the item;

- the item’s lifespan and residual value over a period of time;

- who insures the item;

- who decides on disposal of the item;

- what happens to the item’s residual value.

This agreement is necessary to ensure:

- that the lottery proceeds are used only for charitable purposes; and

- that the residual value of an item is used to support only those initiatives that have also been approved as eligible.

An example of an eligible use of proceeds when a charitable organization donates funds towards a capital expenditure:

A service club raises lottery proceeds towards the purchase of a van for a publicly owned long- term care home to transport patients. The purchase of the van may be an eligible use of proceeds provided the service club can demonstrate that the purchase of the van is over and above the services that the long-term care home would normally provide.

2.4.1 (B) Direct expenses vs. indirect expenses

Eligible organizations must provide very detailed information concerning their proposed use of lottery proceeds. Because many organizations do not have wholly charitable objects or purposes, it is sometimes difficult to determine whether a proposed use of proceeds can be considered a charitable purpose. In broad terms, proceeds may be used to offset the expenses that are integral to the charitable functions of the organization. These are known as “direct expenses.” A direct expense includes any expense that directly helps to fulfil the organization’s charitable mandate.

Organizations have costs that may be classified as direct or indirect expenses. A curling club that runs a youth program as a charitable function, in addition to its adult program, has costs that may be considered as direct or indirect depending on the program for which they are incurred. The cost of ice time necessary to deliver the youth program is eligible as a direct expense if it can be isolated from the cost for the adult program. If the cost of the ice time required for the youth program cannot be determined and isolated, it is not an eligible use of lottery proceeds.

Indirect expenses include the group’s general operating costs such as salaries, administration, rent, or utility expenses such as heat and hydro. Indirect expenses are not generally considered essential for the delivery of the charitable purpose and therefore may not be eligible uses of proceeds.

The licensing authority may approve these expenses if the applicant meets all of the following requirements:

- The need for the expense is justified as an integral part of the eligible charitable objects or purposes and activities.

- Salaries and wages may only be approved if the expertise level and time required cannot reasonably be provided by a volunteer.

- Salaries and wages must be reasonable and geared to the expertise and hours needed to do the work.

2.4.1 (C) Volunteer/staff training

Volunteer and/or staff training may be an eligible use of lottery proceeds. Generally, lottery proceeds may not be used to pay expenses associated with attending, organizing or running conferences or workshops. However, in certain circumstances conferences or workshops may constitute a charitable purpose.

In order to use lottery funds to attend, organize or run a training session, the organization must demonstrate that the training provides a significant charitable and community benefit related to an educational program. The following types of training may qualify:

- programs or workshops that directly provide education for youth, such as summer French programs or youth leadership courses;

- conferences or workshops that train volunteers to fulfil an organization’s charitable mandate, for example:

- training volunteers for Big Brothers, halfway houses and to be counselors at rape crisis centres; or

- training volunteers for community safety programs.

If the conference or workshop is only for personal development or if it only benefits the membership of the organization, it does not constitute community benefit and cannot be funded with lottery proceeds.

The following types of conferences and training are examples that do not qualify as a charitable use of lottery proceeds:

- professional development or upgrading for nurses, teachers, lawyers, doctors and other professionals;

- the payment of tuition fees for a volunteer or staff member of the organization to attend a college, university or any other educational institution;

- membership conferences for service clubs, the Royal Canadian Legion and other veterans’ organizations, and arts and cultural groups; and

- membership fees for the organization, its volunteers or staff in professional or recreational associations.

The licensing authority must determine whether or not the conference or training constitutes a charitable purpose. The following questions will assist in that determination.

- Is the conference/workshop/training directly related to the charitable mandate of the organization?

- Is the conference/workshop/training on the list of uses that do not qualify as outlined in Section 2.5.0, “Ineligible Uses of Proceeds”?

- Will the conference/workshop/training result in a personal or a public benefit?

- What is the charitable benefit the community would gain through the conference/workshop/ training?

Unless the answers to the above questions clearly indicate that a public charitable benefit will result, the licensing authority must not grant the organization permission to use lottery licensing proceeds for the conference, workshop or training expenses.

2.4.1 (D) Research

An eligible charitable organization that conducts research as an integral part of its charitable mandate may apply for a lottery licence to fund the direct costs of that research. Research may be funded through lottery proceeds if it advances human knowledge and if the resulting advances provide a public benefit either through instruction (“the advancement of education”) or by improving the health and well-being of the residents of Ontario (“other charitable purposes beneficial to the community: health and welfare”).

The licensing authority may grant approval on a case-by-case basis, under the following conditions:

- the applicant is an eligible charitable organization conducting the research as part of its charitable mandate; or

- the applicant is an eligible charitable organization that will donate the lottery proceeds to an eligible charitable organization conducting the research as part of its charitable mandate.

2.4.1 (E) Travel costs

The cost of travel for staff, volunteers and individuals benefiting from the charitable activities of the organization may be an eligible use of proceeds. These costs must directly benefit residents of Ontario and must be considered integral to the organization’s eligible charitable objects or purposes and activities.

The following examples are eligible uses of lottery proceeds for travel costs:

- renting a bus to transport an amateur youth sports team to a sanctioned tournament;

- paying for hotel accommodation for a group of students on a school trip which supplements and relates to the academic program.

In some cases, organizations may request approval to pay out-of-province travel costs. The organization must demonstrate that a direct benefit will be provided to the public of Ontario. If the travel provides only a private benefit, the travel costs are not eligible. A licensing official must determine the type of benefit provided on the basis of the organization’s charitable object or purpose and activity.

A licensing official must consider requests for approval to pay out-of-province travel costs with lottery proceeds on a case-by-case basis. For example, out-of-province travel to advance education, particularly for youth, is eligible.

On the other hand, out-of-province travel is not an eligible use of lottery proceeds for an arts or cultural organization. Arts and cultural organizations must provide a benefit directed towards the broader public of Ontario, not the individual members of the performing organization. When the performance is outside Ontario, the audience is not made up of Ontario residents. Therefore, the benefit of the travel is considered a private benefit directed to the individual performers. This also applies to school bands travelling out-of-province for the sole purpose of performing while travelling.

2.4.1 (F) Senior citizen centres and programs for senior citizens

The courts have recognized that support to “the aged” (senior citizens) through programs that improve physical and mental health may be considered charitable in nature.

These types of programs may fall under the eligible charitable category of “relief of poverty” or “other purposes beneficial to the community” depending upon the activity. For example, programs that provide relief from loneliness and isolation of the aged, and improve their mobility and fitness may be eligible under “Other purposes beneficial to the community: Health and welfare.” A non-profit organization that is established to operate and maintain a senior citizens’ centre or seniors’ social club to provide recreation, cultural activities and other programs for senior citizens may also be eligible for licensing.

The licensing authority may grant approval on a case-by-case basis, under the following conditions:

- A senior citizen group is one in which the majority of its members is 60 years of age or older.

- The applicant is an eligible charitable organization that provides social and recreation programs to seniors so they remain active in the community.

- Eligible senior programs must be available to all seniors in the community who wish to participate.

- The benefit must not be restricted to an exclusive group.

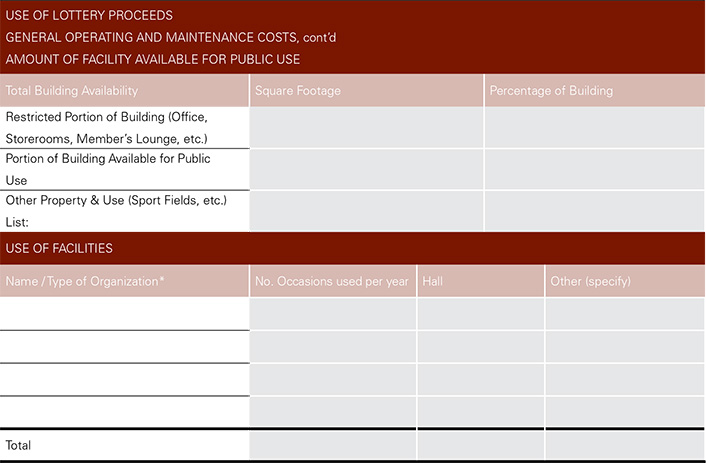

- Maintenance costs including utilities, property taxes, liability insurance, cleaning and maintenance of senior citizen centre buildings may be eligible uses of proceeds if they are reasonable and necessary expenses in carrying out the charitable programs and services.

2.4.1 (G) Amendments to the approved uses of proceeds

An organization cannot use lottery proceeds for any purpose that was not approved on the original licence application, unless it obtains prior written authorization from the licensing authority.

To obtain an amendment to its proposed use of proceeds, an organization must submit a written request to the applicable licensing authority setting out the reasons for the requested amendment. The requested uses must be related to the direct delivery of the objects or purposes of the licensee. The licensing authority has the right to refuse to amend the approved uses of proceeds.

2.5.0. Overview: Ineligible Use Of Proceeds

A proposed use of lottery proceeds is ineligible if:

- it provides a personal benefit or gain to the members of the applicant organization;

- it supports tourism or other purely economic benefits;

- it advances a particular political issue;

- it enhances lands and buildings owned and/or operated by a government;

- it is a responsibility that has traditionally been fulfilled by a government; or

- it funds activities that do not fall within one of the four charitable classifications.

2.5.1. POLICIES: INELIGIBLE USE OF PROCEEDS

Eligible organizations may not use the proceeds from lottery licences for:

- the cost of political lobbying and/or advocating a particular view on a political issue, including the cost of staffing, publication materials and advertising;

- fundraising activities, including wages for a fundraiser and the cost of promotional materials;

- administrative or other activities that are not integral to the direct provision of the organization’s charitable mandate;

- the provision of services for which the organization receives government funding or which the organization is required, by law, to provide;

- legal fees/costs incurred by the organization or its board;

- volunteer recognition;

- foreign aid, out-of-province aid or aid to non-Ontario residents;

- accounting fees, except as provided by the terms and conditions of the lottery licence;

- out-of-pocket expenses for volunteers to participate in a licensed lottery event, except as permitted under the terms and conditions of the lottery licence;

- academic and sports awards and trophies;

- construction, renovation or improvement of buildings owned by or on land owned by the Government of Canada, the Province of Ontario or municipalities; and

- any activity that does not fall into one of the four charitable classifications.

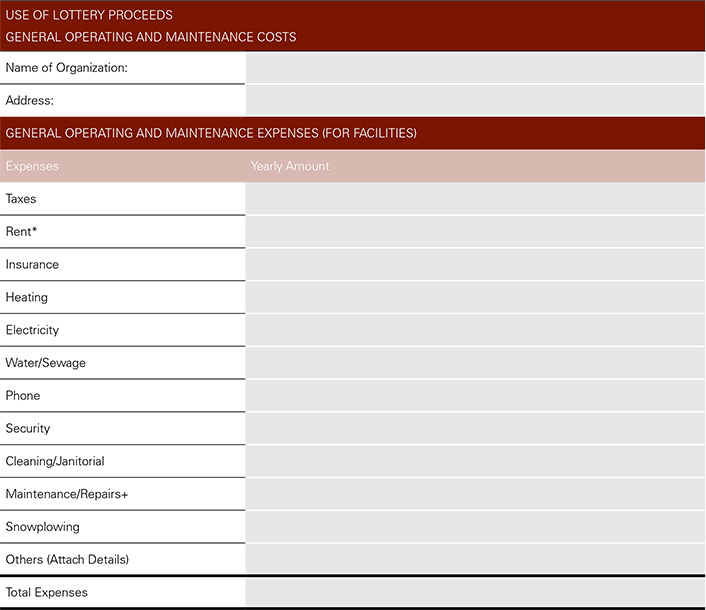

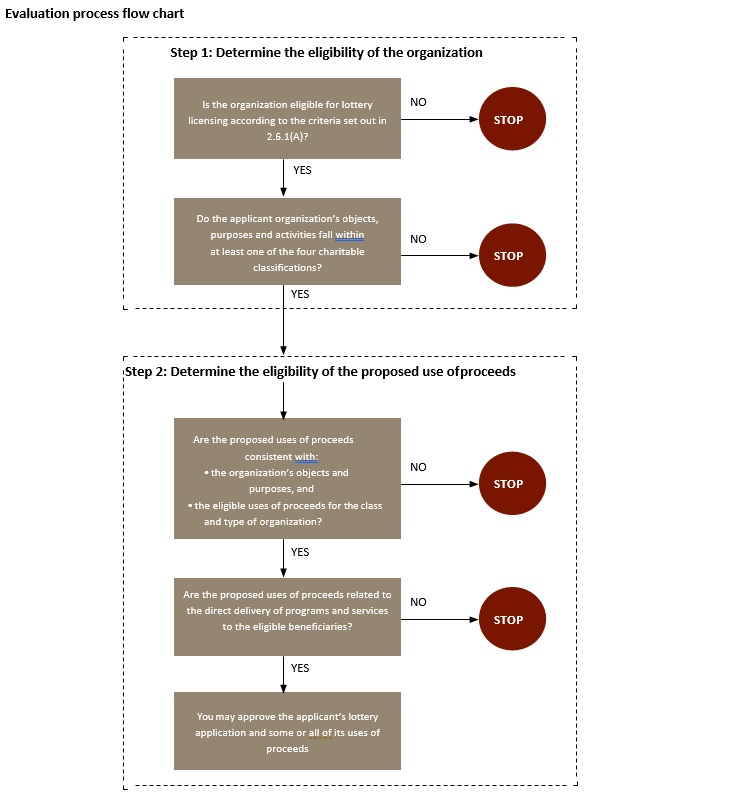

2.6.0. Evaluation Process

This section provides an overview of the process to determine whether or not an organization is eligible for lottery licensing, and whether or not its proposed use of proceeds is eligible.

STEP 1: Determine the eligibility of the organization

- Is the organization eligible for lottery licensing according to the criteria set out in 2.6.1(A)? If not, stop here. If the organization is eligible, continue.

- Do the applicant organization’s objects, purposes and activities fall within at least one of the four charitable classifications? If so, which one:

- the relief of poverty

- the advancement of education

- the advancement of religion

- other charitable purposes beneficial to the community, not falling under i), ii) or iii).

If the organization’s objects and purposes are eligible, continue to Step 2. If not, the organization is ineligible for a lottery licence and the process stops here.

STEP 2: Determine the eligibility of the proposed use of proceeds

To evaluate the use of proceeds, ask the following questions:

- Are the proposed uses of proceeds consistent with:

- the organization’s objects and purposes, and

- the eligible uses of proceeds for the class and type of organization?

- Are the proposed uses of proceeds related to the direct delivery of programs and services to the eligible beneficiaries?

If the answer to both questions is “Yes,” the applicant’s lottery application and some or all of its proposed uses of proceeds may be eligible for lottery licensing.

2.6.1. NEXT STEPS: EVALUATION GUIDELINES

2.6.1 (A) Evaluating the organization

To be eligible for lottery licensing, an applicant must have an established organizational structure. The applicant must be a legal entity and must have a formal document that establishes the organization. However, incorporation, whether provincial or federal, is neither a prerequisite nor a guarantee that a licence will be issued. No one may use lottery proceeds to start up an organization.

In order to be eligible, an organization must:

- have been in existence for at least one year;

- have provided charitable community services consistent with the primary objects and purposes of the organization for at least one year;

- have a place of business in Ontario;

- demonstrate that it is established to provide charitable services in Ontario;

- propose to use proceeds for charitable objects or purposes that benefit Ontario and its residents; and

- assume full responsibility for the conduct and management of its lottery events.

The terms and conditions for each lottery licence set specific application requirements, which are summarized in the relevant licensing policy sections of this manual.

When an organization first applies for any type of lottery licence, or whenever a review of its eligibility is required, it must provide all of the following information and documents that apply to it:

- a copy of its letters patent;

- a copy of its constitution and bylaws;

- a copy of its budget for the current year;

- a copy of its financial statements for the preceding year;

- a list of its Board of Directors;

- its latest report to the Public Guardian and Trustee;

- its charitable number for income tax purposes;

- a copy of its “Notification of Registration” letter from the Canada Revenue Agency with any supporting documentation, indicating the applicant’s status and terms of registration;

- copies of its charitable returns to the Canada Revenue Agency for the previous calendar year;

- a detailed description of its activities; and

- a copy of its annual report.

The organization must also provide any other information that will assist the licensing official to determine the charitable nature of its objects, purposes and activities.

After the review has been completed, the licensing officer may require additional information to process the application. The organization must provide any information that is requested.

If any changes are made to the documents submitted, the organization must provide the licensing authority with the amended documents as soon as they are available.

Because organizations change, an organization that is considered eligible for lottery licensing must continue to provide the licensing authority with any amended documents as soon as they are available.

Organizations that receive lottery licences will be subject to periodic eligibility reviews.

2.6.1 (B) Evaluating the use of proceeds

In order to determine eligible uses of proceeds, the organization must set out in detail its proposed uses of proceeds and to which programs the proceeds will be applied. The organization’s proposed use of proceeds must be for charitable programs and the programs must be consistent with the charitable objects and purposes of the organization. These objects and purposes must be of a charitable nature and fall within at least one of the four charitable classifications listed in Section 2.1.0.

In addition to the policies for “Use of Proceeds” and examples of “Eligible Uses of Proceeds” provided throughout this chapter, the following guidelines may be used to evaluate and determine eligible uses of proceeds:

- A copy of the most recent financial statements should show through past expenditures that contributions to support the charitable objectives of the organization have been made and that the organization is carrying out its charitable objects.

- The current operating budget should itemize each of the projected revenues and expenditures of the organization. The organization’s proposed use of proceeds (as detailed in the lottery licensing application) should coincide with the line items in their current operating budget. As well, the operating budget should demonstrate a need for the lottery proceeds.

- The use of lottery proceeds should be restricted to expenditures which are related directly to the delivery of the charitable programs provided by the organization. In other words, lottery proceeds must not be used for programs that are not part of the organization’s charitable objects and purposes identified in the constituting documents.

- In limited cases, certain administrative expenses related to the direct delivery of an eligible organization’s charitable objects may be considered eligible uses of proceeds. These costs must be essential to the direct delivery of the charitable services and must be approved by the licensing authority on a case-by-case basis. (See also “2.4.1(B) Direct expenses vs. indirect expenses” for further information.)

2.6.2. NEXT STEPS: ELIGIBILITY QUESTIONNAIRE

The licensing official must assess the applicant’s eligibility by asking the following questions. If the answer to any of these questions is “no,” the organization is ineligible.

- Does the organization’s purpose fall within one of the four classifications of charitable objects?

- If yes, which one:

- the relief of poverty;

- the advancement of education;

- the advancement of religion;

- other charitable purposes beneficial to the community, not falling under (a), (b) or (c);

- none of the above — stop here.

- Does the organization have a place of business in Ontario?

- Has the applicant been in operation for at least one year and does it have a proven charitable mandate that it has carried out throughout the year?

- Is the organization established to provide charitable services in Ontario and use proceeds for objects or purposes that benefit only Ontario residents? If not, has the organization requested a use of proceeds that is restricted to meet these requirements?

- Is the applicant properly organized so that it is separate organizationally, legally and financially from any other organization?

- Are the proposed uses of proceeds eligible?

- Is the intended use a direct delivery of services that is consistent with the charitable classification and the governing documents of the organization?

- Are the proposed charitable benefits open to all segments of the community? Or, if the charitable benefits are directed to a specified group of the public, are the benefits open to all segments of that group?

2.6.3. NEXT STEPS: CONSTITUTING DOCUMENTS

Every applicant organization must have a document that establishes the organization, setting out the members’ common purpose and detailing how the organization will operate in order to achieve that purpose. Formal documents include letters patent, constitution, and memorandum of association. Informal associations that have not adopted formal written constituting documents are not eligible for lottery licensing.

The organization must demonstrate that the following items are included in its constituting documents:

- the organization’s name;

- the organization’s object or purpose;

- a description of how an individual becomes a member of the organization and retains membership in the organization;

- a clause stating that the organization’s members will not derive any gain from the organization, and that any profits will be used solely to promote the organization’s objectives;

- a description of the organization’s structure (for example, president or chair, secretary, treasurer);

- a description of how the organization elects its directors;

- the signature of the officers who adopted the incorporating documents;

- the signature of at least three of the organization’s current directing officers, certifying that the incorporating documents are current and still in effect;

- the effective date of the instrument;

- a general dissolution clause that addresses the winding up of the organization; and

- a further clause (which may be contained in the bylaws) that, if the organization should dissolve, provides for the distribution of the organization’s assets and property held or acquired from the proceeds of licensed lottery events (that is, lottery trust accounts or property purchased with lottery proceeds) to charitable organizations that are eligible to receive lottery proceeds in Ontario.

2.7.0. Next Steps: Classification Guidelines

The guidelines in this section are intended to help licensing officials determine:

- whether the applicant falls within one of the four charitable classifications; and

- how an eligible organization may use the net proceeds of a licensed lottery event.

An organization’s charitable classification determines its eligible uses of lottery proceeds. The four classifications are:

- the relief of poverty;

- the advancement of education;

- the advancement of religion;

- other charitable purposes beneficial to the community, not falling under (a), (b) or (c).

The lists of eligible uses below are not intended to be exhaustive. A licensing authority may approve other proposed uses, depending upon the specific mandate of the organization. Any eligible organization, regardless of its charitable classification, may be approved for other uses of proceeds, provided that those uses are:

- charitable and advance the charitable objects or purposes of the organization;

- required for the direct delivery of the charitable objects or purposes of the organization; and

- directed toward a large portion of the community or residents of Ontario with a common need.

When an application is approved, the application for the licence forms part of the licence itself. If the licensing authority does not approve all the requested uses of proceeds, the approved uses of proceeds and any restrictions must be specified on the licence when it is issued.

Licensees wishing to use proceeds for any purpose not requested on their original application must request a licence amendment and receive approval before using the proceeds for those purposes.

See also “2.4.0. Overview: Eligible use of proceeds”“2.4.1. Policies: Eligible use of proceeds”, “2.4.1(G) Amendments to the approved uses of proceeds” and “2.5.1. Policies: Ineligible use of proceeds” .

2.7.1. POLICIES: THE RELIEF OF POVERTY

2.7.1 (A) Eligibility guidelines for the relief of poverty

To be eligible in this classification, a charitable organization must meet all of the basic eligibility criteria set out in this chapter and must demonstrate that its programs and services assist those who are:

- in financial need;

- distressed or suffering as a result of their financial circumstances; or

- experiencing economic disadvantage.

2.7.1 (B) Eligible organizations for the relief of poverty

Examples of the types of organizations that may be eligible in this classification include:

- street patrols who work directly with homeless people;

- food banks;

- shelters for the homeless and economically disadvantaged; and

- meal programs.

With prior approval from the licensing authority, a charitable organization may use lottery proceeds to set up a fund to assist those in financial need. The fund must provide assistance to address a common need and must be available to anyone in the community who has that need. Approved uses of the fund may include the provision of short-term relief or a one-time payment to relieve an exceptional condition or circumstance (for example, floods that result in devastation to an Ontario community). More than one charitable organization may contribute to the fund, provided it falls within the charitable organization’s mandate. Payments must be made directly to the service provider/retailer.

2.7.1 (C) Eligible uses of lottery proceeds

The licensing authority may approve eligible organizations in this classification to use lottery proceeds for the direct delivery of services for:

- temporary shelter or subsidized rental accommodation;

- food, supplies and clothing;

- client life skills training, instruction and support intended to alleviate the effect of living in poverty;

- transportation costs for clients to attend programs or access services/resources;

- non-profit daycare services, where the funds are used:

- for programs not historically funded, and

- for the purpose of allowing access to those persons who could not otherwise afford the service (the organization must have criteria in place to determine eligibility); and

- out-of-pocket expenses for staff and volunteers, including travel costs, for the direct delivery of charitable services to the clients, where receipts are provided (for example, where staff or volunteers are required to use their own vehicle to deliver the service).

2.7.2. POLICIES: THE ADVANCEMENT OF EDUCATION

2.7.2 (A) Eligibility guidelines for the advancement of education

To be eligible in this classification, an organization must meet all the basic eligibility criteria and restrictions on uses of proceeds set out in this chapter. Proceeds cannot be used to fund core programs or services. They must demonstrate that its programs and services:

- provide significant scholastic or vocational training or instruction;

- develop intellectual capacity or teach necessary life skills; or

- engage in research that improves human knowledge, and disseminate that knowledge to the public.

Normally, the training or instruction provided will lead to a recognized degree, diploma or certificate.

Eligible charitable organizations must demonstrate that:

- lottery proceeds are used to enhance the educational and extracurricular opportunities of a broad cross-section of students, over and above statutory requirements established and funded by the Province;

- programs and services do not simply promote a particular point of view; and

- programs and services confer a significant public educational benefit, not a private benefit.

Education for the professional development of a person or group (such as training courses for teachers, lawyers and nurses) is not an acceptable use of funds in this classification.

An organization that provides a program or curriculum that is contrary to the laws of Ontario or Canada or international law is not eligible for lottery licensing.

2.7.2 (B) Eligible organizations for the advancement of education

Examples of the types of organizations that may be eligible in this classification include:

- public and Roman Catholic schools (elementary and secondary) that are recognized and/or accredited by the Ministry of Education and lead to a secondary school graduation diploma;

- monastic and other religious schools and private schools that are registered with the Canada Revenue Agency as charitable organizations, and provide programs that are accredited by an appropriate government agency;

- colleges, universities and schools of the arts whose programs lead to a recognized certificate or degree;

- scholarship or bursary funds registered with the Canada Revenue Agency as charitable organizations, where:

- beneficiaries are selected from a widely based group on the basis of merit and/or need,

- there is non-restricted access to the programs, and

- funds are directed to an accredited educational program; and

- organizations that provide formal educational activities and training in necessary life skills, such as “English as a Second Language” programs.

In the case of schools, the lottery licensing applicant must be the school itself, not a class or department within the school. However, parent/teacher associations or other groups may also be eligible for lottery licensing, provided that they:

- support one of the types of schools listed above; and

- are properly constituted as charitable organizations or non-profit organizations with charitable objects.

Only one related eligible organization may be licensed at any one time to fund the same educational purpose, school, program or governing body. Therefore, the school and its parent/teacher association may not both hold lottery licences. The parent/teacher association is only eligible for lottery licensing if the school determines that it will not raise funds through charitable lotteries.

School councils required by the provincial government are not eligible for lottery licensing.

2.7.2 (C) Eligible uses of lottery proceeds for the advancement of education

Proceeds raised from lotteries cannot be used to fund core programs or services. The definition of core programs or services depends on what has been historically provided by the individual school and what is mandated by the provincial government. Additionally, eligible uses may vary between boards of education and schools in the same community.

The licensing authority may approve eligible organizations in this category to use lottery proceeds for the following purposes, so long as they are not historically provided by the organization or mandated by the provincial government:

- non-profit student publications such as newsletters and yearbooks that are provided at a nominal or no cost;

- educational student conferences and field trips within Ontario;

- student organizations such as arts/drama clubs and student councils/ unions;

- academic competitions;

- student athletics programs: uniforms, sports equipment, safety equipment, fees for qualified officials (where necessary) and facility rental fees;

- registered scholarships and bursaries open to Ontario residents (as per Section 2.7.2(E)); and

- travel, including out-of-province travel, provided that it complies with the requirements set out in Section 2.4.1(E).

Schools may only use lottery funds to purchase non-core services, items or equipment as approved by the lottery licence. Schools may not use lottery proceeds for the purchase, construction or renovation of facilities or buildings or to purchase other capital assets, such as school buses.

The lottery proceeds raised must be used for the overall benefit of the school. For example, lottery proceeds raised for athletic programs must be used to support all representative sports teams within the school, not just selected teams.

2.7.2 (D) Donations of lottery proceeds for the advancement of education

Schools may receive donations of lottery proceeds raised by eligible organizations for approved uses. In some cases, an eligible organization may purchase or donate funds towards the purchase of a non-core item that has not historically been provided by the school.

Prior to a capital expenditure, the board and the donating organization must enter into an agreement outlining their respective responsibilities. This agreement must include the following information:

- who will hold title to the item;

- who maintains the item;

- the current value of the item;

- the item’s lifespan and residual value over a period of time;

- who insures the item;

- who decides on disposal of the item; and

- what will happen to the residual value of the item and how will it be spent.

This agreement is necessary to ensure:

- that the lottery proceeds are used only for charitable purposes; and

- that the residual value of an item is used to support only those initiatives that have also been approved as eligible.

2.7.2 (E) Eligible use of lottery proceeds for bursaries and scholarships

Lottery proceeds may be used to establish or support scholarship or bursary funds for educational purposes, under the following conditions:

- the establishment or support of such a fund is integral to the organization’s mandate;

- the fund is registered with the Canada Revenue Agency as a charitable organization;

- the scholarships or bursaries are designed to allow a significant number of students in the community to apply; and

- the scholarships or bursaries are used for an educational program that leads to a recognized degree, diploma or certificate.

A scholarship fund that allows only a limited number of applicants, such as the children of members of a small service club, to apply would be considered too narrowly focused. Lottery proceeds may not be used for this purpose.

Scholarships or bursaries for the development of established professionals are also ineligible.

2.7.3.POLICIES: THE ADVANCEMENT OF RELIGION

2.7.3 (A) Eligibility guidelines for the advancement of religion

The “advancement of religion” refers to promoting the spiritual teachings of a religious body and maintaining the doctrines and spiritual observances upon which those teachings are based.

To be eligible in this classification, an organization must meet all the basic eligibility criteria set out in this chapter and must demonstrate that its programs and services assist in the delivery of religious services and programs to the community. Additional objectives of religious organizations usually include support of the poor, sick and destitute as well as a host of other charitable objectives. In order to be eligible, an organization must demonstrate:

- one of its primary purposes is the advancement of religion;

- its credentials regarding the religion it advances;

- its affiliation with the religion it advances; and

- how it advances that religion.

Activities that advance religion may include:

- organizing and providing religious services and guidance;